Fedcoin is being created as a way for the federal reserve to issue a new currency that runs parallel to the dollar. This new cryptocurrency that will be created by the Fed would potentially be swappable for your US dollars and would allow the Fed to issue currency directly into the hands of people. This essentially puts the big banks out of business, but behind the curtain, the big bank owners are the private shareholders of the Fed. As a reminder, the Fed is a private corporation that has been given the exclusive rights to print physical currency or create digital 1’s and 0’s out of thin air.

The Fed has been trying to create inflation as a hidden tax to wipe out the US government debt. Why would it do this? By helping the government wipe out its debt through inflation, that makes the dollars they’re lending less valuable. But remember, they didn’t have to do anything for the original dollar they created. They just printed it from nothing. So if it returns to the less valuable, they could care less. What they do care about is helping the government do what it wants so that they can continue to have the enormous privilege of printing money. And the government wants to be able to fund its perpetual wars around the world, provide programs that benefit its constituents so that it can become bigger and more powerful. The constitution expressly states the government is not allowed to print money, only gold, and silver, so this was a workaround that worked for both parties, but detrimental to the average person without them even realizing what was happening to their wealth. That’s why the so-called debt ceiling has been completely removed by the King of Debt himself, Donald Trump. Removing the pretend constraints of the government to reign in its insatiable spending habits paves the way for socialists to come in and spend away.

The MMT crowd (Modern Monetary Theory) says you can have unlimited amounts of debt because the Fed can just print the money. No need to borrow money (since no one will lend the US money anymore) and no need to tax its citizens (because inflation is a hidden tax on EVERY citizen which mostly affects the poor and the middle class). But most people don’t understand that inflation is a hidden tax. What it does is makes everything you pay for more expensive and the dollars you hold in the bank, less valuable. And now that those dollars are less valuable, the new money that gets created first goes into the hands of the government and the very wealthy, which goes to pay back the enormous debt. But this is a debt death spiral that has no happy ending.

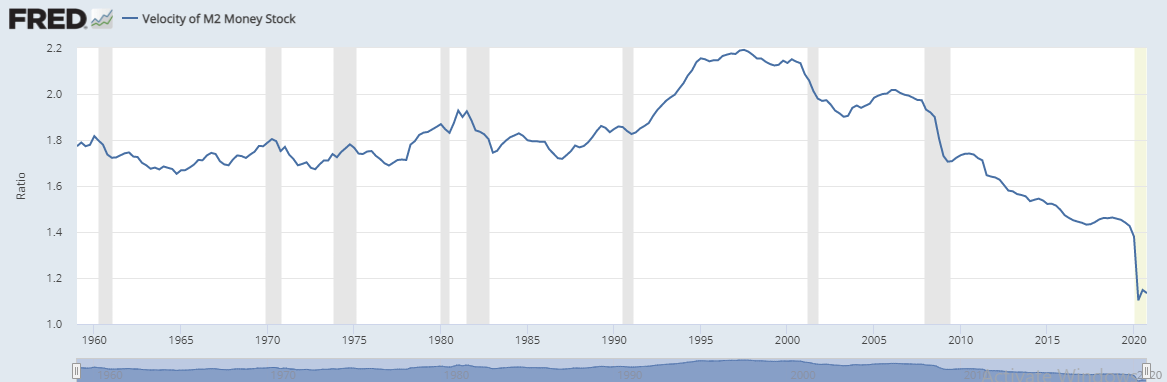

But we haven’t had substantial rising prices and the Fed has blown up its balance sheet by trillions of dollars in the last 20 years. This is where FedCoin comes into play and the elimination of cash. Inflation doesn’t come from printing money alone. You need the turnover of money in the economy for it to rise. This is called the velocity of money. (Please see my previous post about the Velocity of money compared to the movie Speed, to understand that better.). Velocity has been steadily decreasing since the mid-1990s which coincidentally is when the money supply has increased to counteract this trend. You can see this trend on the Fed’s website. https://fred.stlouisfed.org/series/M2V

So with all of this money sloshing around, why has spending in the economy slowed? That money sloshing around has created massive bubbles in the stock market (dot com bubble in 1999 and 2000), and the housing bubble in 2007 which led to a financial crisis, which led to even more money printing and the repo bank crisis (that almost no one knows about) in Sept of 2019, which stabilized from even more money printing hidden by the current crisis…. Which has led to the velocity of money plummeting by shutting the world down. So the FedCoin will allow the Fed to issue money directly to the people to get people to spend money in the economy and get the engine going again. By eliminating cash and issuing a Fed crypto, they can now charge negative interest rates if you keep your money in the bank. This forces people to go out and spend the money the second they get it… otherwise, they take it away if you don’t. As velocity increases, prices increase and the value of the money comes down. They can also track your purchases and share that information with the government. If you ever heard the term “helicopter money” which gives you the image of the central bank thrown cash out of the helicopter, this is the digital version of that. The citizens will gobble it up as it looks like free money dropping from the skies that they didn’t have to work for. Which will only increase the move away from the US holding the world reserve currency. That may be closer than you think!

The SDR (Special Drawing Right) which is world money issued by the IMF (International Monetary Fund) is also creating a cryptocurrency to allow countries to trade world money globally instead of the dollar. The issuance of SDRs has only happened 3 times in the past.

1969 – When the French recognized the US was printing too many dollars to pay for the Vietnam war and FDR’s socialist programs like Social Security, Medicare, and Medicaid. There was a run on the bank, so to speak as the world began to exchange their dollars for the gold held at Fort Knox. That gold diminished from 20,000 tons down to 8,000 tons when Nixon removed the dollar from being backed by gold. During this time the IMF issued its first SDRs (roughly 9 billion) to keep the world economy cranking during this rough patch.

1979 – The US began to see a small form of hyperinflation. The dollar lost 50% of its purchasing power. Because the dollar was plunging, the IMF issued another 12 billion SDRs as the world was fleeing the dollar. This was stifled in the ’80s with the Fed raising interest rates to 21.5%! Also, the US struck a deal with Saudi Arabia to sell oil only in dollars for US military protection.

2009 – 200 billion SDRs re-liquified the economy during the financial crisis.

Today the IMF is considering 350 billion SDR issuance to liquefy the world. And side note, the SDR is also backed by nothing and also printed out of thin air. The value is a percentage value of a specific group of countries’ currencies, that are all backed by nothing and printed out of thin air. However, SDRs are only issued to countries, not individuals.

This new world money crypto will be game over for the dollar. All of those dollars that have been printed over the years will come flooding back as the world looks to spend its dollars in the only place they’re accepted, in the US. And prices for all assets will skyrocket. The US government will get the inflation it had hoped for, to wipe out its debt, but at the cost of the wealth and its citizens.

Just imagine the scene in the 1989 film Batman with Michael Keaton and Jack Nicolson, where the Joker ran a parade through the heart of Gotham, dropping cash down to the citizens below. “Money, money, money. Who do you trust? Me? I’m giving away free money. And where is the Batman? He’s at home, washing his tights!” Then as the citizens cheer him on with his rain of cash from the skies, he gives the order to gas them all.

Gold and Silver is your Batman in this situation. It’s not digital and therefore not traceable. No negative interest rates, and has held its value for over 5000 years. Get it while you still can! The loan’s on assets like housing can be good plays too if you can find housing that creates residual income. Remember, if government debt gets wiped out by inflation, so does your private debt. But you have to be smart about it and not buy homes that don’t bring in residuals. The residuals will pay back those loans with cheaper dollars. And you can purchase my course on buying residual income-producing properties in the US on the money-act website!

Be on the lookout for FedCoin, coming to a digital wallet near you!